car lease tax deduction calculator

Ad Vergelijk aanbiedingen van verschillende leasemaatschappijen op prijs en voorwaarden. Multiply the base monthly payment by your local tax rate.

Is Buying A Car Tax Deductible Lendingtree

Operating Lease in the US.

. Monthly depreciation monthly interest amount monthly tax amount monthly lease payment. If you were to claim the Section 179 deduction you could take a 15000 deduction 20000 075 on your 2021 tax return which youd file in early 2022. Say your business use is 60 percent and you are making a monthly payment of 400 on it.

Thanks for the. Lets say your lease is 500 per month. In this case also an employer is needed to maintain the official records of date of visit places visited petrol consumed and other billing documents which is.

Another common reason is a lifestyle change. If you are a cash basis taxpayer as most of us are you can only take the amount of tax paid in 2017 on your 2017 return. If you decide to take out a business car lease you could claim back up to 100 of the tax.

If you want to lease it for 12 months the minimum monthly payment will be about Rs. You can calculate taxable value using commercial payroll software. Enter the total number of days the vehicle was leased in the tax year and previous years 3 4.

It certainly gives you an easier to figure deduction. For example maybe the renters family has grown and the 2-seater convertible is not big enough or because of a new longer ride they want a. Enter the total lease charges payable for the vehicle in the tax year 1 2.

Ad Bereken je maandbedrag voor je zakelijke auto met de Lease Calculator van regeljeleasenl. Finally to calculate your monthly lease payment youll add these three charges together. Also lease payments that are considered operating leases are tax-deductible as a business expense which can help reduce a business or companys tax bill.

Your mileage deduction would be 4840. It can be used for the 201314 to 202122 income years. Met financial lease betaal je een vast maandbedrag en ben je zelf eigenaar.

You use your car 80 for business. On the other hand business leasing allows you to claim back up to 50 of tax on the rentals and up to 100 on a maintenance package. Car Lease Tax Deduction Calculator.

7 For example lets say you spent 20000 on a new car for your business in June 2021. P11D value of the car x CO2 Benefit-in-kind tax rate x Personal income tax rate Heres an example. Calculate Tax Over Lease Term.

Car leasing as a business owner. Also include any state and local general sales taxes paid for a leased motor vehicle. However youll need to qualify for a business lease.

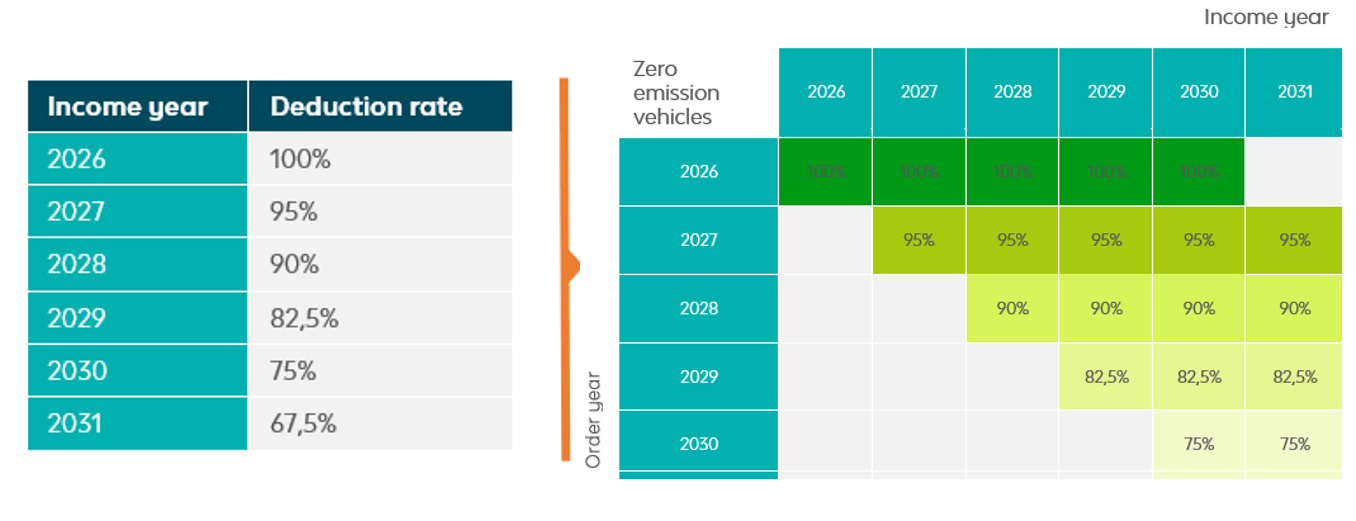

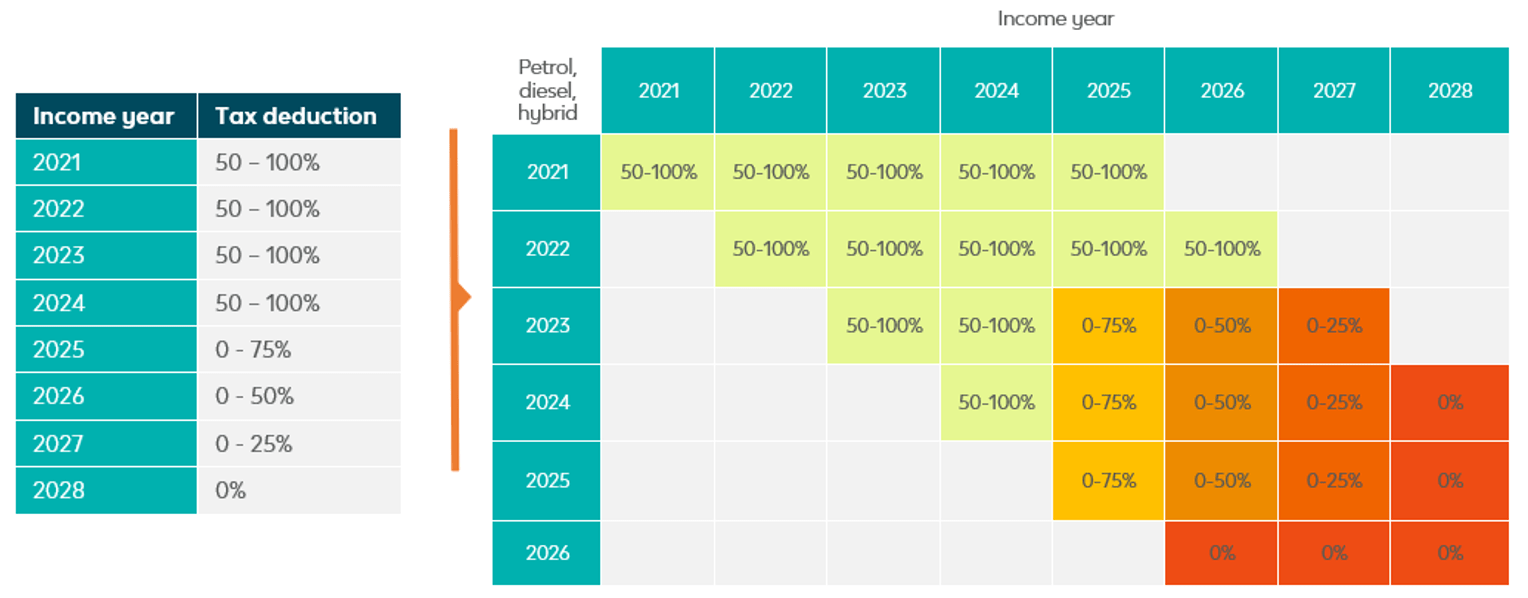

Number of days in 2021 she leased the car 184 Prescribed CCA capital cost limit 30000 Prescribed CCA capital cost limit Prescribed limit rate. There will be a gradual increase in the private use addition rate bijtelling for zero emission company cars such as electric cars hydrogen-powered cars and solar-powered cars. You can write off 240 for every single lease payment the same formula applies to the other car expenses in the above list -- gas insurance depreciation etc.

Your payments total 6000 per year and your deduction is 4800. -- you ought to be deducting too. Your estimated IRS mileage deduction is 34500 over the course of your lease.

Eligible vehicles include cars station wagons and sport utility vehicles. So you could take off only the July - Dec payment that you made in 2017. Tally your car lease costs Add up all the costs associated with your leased car.

If theres no sales tax in your state you can skip this step. The deduction limit in 2021 is 1050000. The addition also applies if you lease an electric car.

30000 P11D value x 25 CO2 Benefit-in-kind tax rate x 40 Income tax rate 3000 annual company car tax bill The P11D value will be available from the car manufacturers website along with the vehicles CO 2 emissions rating. 35294 GST 1 and PST or HST 1 on 35294 5. LeaseVergelijker is de grootste onafhankelijke autolease website van Nederland.

A finance lease cost is calculated using the overall cost of the vehicle the length of your contract and the chosen end payment balloon payment. The computation of tax implications will be as follows. But its not all doom and gloom as there are savings to be made.

Monthly payments according to cities These prices are representative. You need to keep records Where you and another joint owner use the car for separate income-producing purposes you can each claim up to a maximum of 5000 business kilometres. When you lease a car through a Personal Contract Hire PCH agreement the monthly price quoted will be inclusive of VAT which will be charged at 20 of the total cost of your agreement.

Enter the manufacturers list price 4 5. Ad Bereken je maandbedrag voor je zakelijke auto met de Lease Calculator van regeljeleasenl. LeaseVergelijker is de grootste onafhankelijke autolease website van Nederland.

The lending financial institution for the lease has placed a residual value of 12500 on the car after the 3 years and has given the lessee an APR of 6 after a down payment of 5000. If you buy the car as Tim Boardwell said A year end interest statement and a depreciation schedule were more complicated. On this page Before you use this calculator When you cant use the calculator Access the calculator.

Ad Vergelijk aanbiedingen van verschillende leasemaatschappijen op prijs en voorwaarden. Assume that the down payment is solely to reduce the capitalized. 30000 100 85 35294 Prescribed deductible leasing costs limit 800 GST and PST on 30000 3900 GST and PST on 35294 4588 GST and PST on 800 104.

With business leasing youll usually be required to pay tax that is calculated from the cars CO2 emissions the P11D value list price of the car and your personal income tax bracket. Met financial lease betaal je een vast maandbedrag en ben je zelf eigenaar. Or you can use HMRC s company car and car fuel benefit calculator if it works in your browser.

Calculating your total mileage deduction To use the example above lets say your total business mileage for the year is 8000 4000 from January to June and another 4000 from July to the end of the year. To calculate your deduction multiply the number of business kilometres you travel in the car by the appropriate rate per kilometre for that income year. Using the HMRC calculator Choose.

However if your total itemized deductions dont exceed the standard deduction 12200 for single filers and 24400 for those married filing jointly you may choose not to itemize at all in which case you cant deduct the sales tax you pay on your vehicle lease or purchase. Sales Tax Deduction Calculator. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

Actual prices may differ depending on the car and the tenure of the lease agreement and other factors. 9100 per month for 48 months. You can lease a car for as little as Rs.

For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment. For more information or to do calculations regarding auto leases. You use the car for business purposes 75 of the time.

This makes the total lease payment 74094. Thats because 4000 times 0585 is 2340 and 4000 times 0625 is 2500. Enter the total lease payments deducted for the vehicle before the tax year 2 3.

This private use addition is a percentage of the list price over which you pay income tax. Deduct a amount of Rs 2400 from the above figure for a car above 16 litres OR a amount of Rs 1800 for a car below 16 litres. The balloon payment is chosen by the lessee and depends on how much you have agreed for your initial rental payment and monthly instalment fees to be.

Lease payments insurance costs.

What Are Tax Deductible Car Expenses Gofar

Car Expenses What You Can And Cannot Claim As Tax Deductions

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Company Car Dienstwagen And Its Tax Implications Mkenya Ujerumani

Vehicle Tax Deduction 8 Cars You Can Get Tax Free Section 179 Youtube

Writing Off A Car Ultimate Guide To Vehicle Expenses

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Save On Taxes With The Company Car When You Buy It

Vehicle Tax Deduction 8 Cars You Can Get Tax Free Section 179 Youtube

Vehicle Tax Focus On A Greener Company Car Fleet Leaseplan

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

Generate Rent Receipt With All India Itr Income Tax Income Tax Return Tax Refund

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Real Estate Lead Tracking Spreadsheet Free Business Card Templates Tax Deductions Music Business Cards

Best Vehicle Tax Deduction 2022 It S Not Section 179 Deduction Youtube

Is Your Car Lease A Tax Write Off A Guide For Freelancers